Estimated reading time: 10 minutes

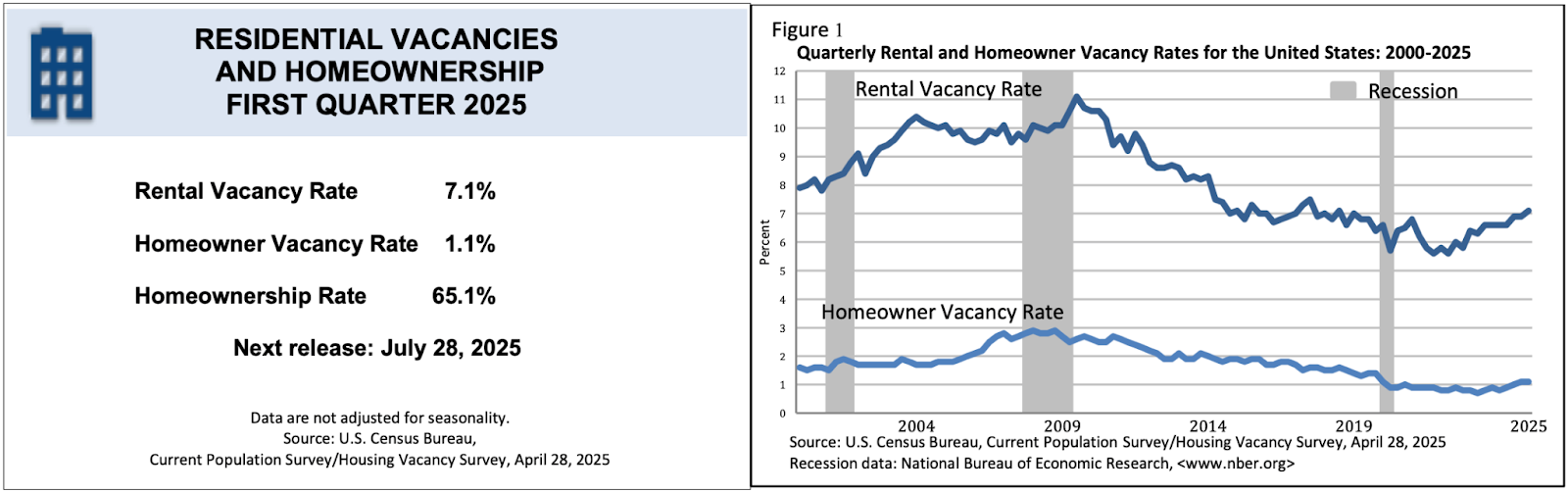

The real estate market remains robust. The Census Bureau reported that the homeownership rate in the U.S. is over 65%, implying that the rest are likely renting a place. The report also cites that the homeowner vacancy rate is 1.1%, while the rental vacancy rate exceeds 7%.

Staying on top of your real estate finances, however, can be challenging. Whether you’re paying for a mortgage or renting an apartment, you have to plan for your finances deliberately. Think about how you can save on your monthly amortization or rent, utility costs, and all other housing-related expenses.

In this article, we’ll share financial planning tips for both homeowners and renters in 2025. Read on to learn more about how to manage your finances for your real estate expenses.

Financial Planning for Real Estate: Key Factors To Consider

Financial planning is precisely what it sounds like—planning how to manage your finances. This involves building your source of income and allocating budgets for all expenses. The ultimate goal, however, is to earn more than you spend.

Financial planning practically applies to real estate. You need to plan on how to handle your finances not only for your business on commercial property but also for your residential property. Whether you own this house or only rent the place, you must keep up with all housing-related costs.

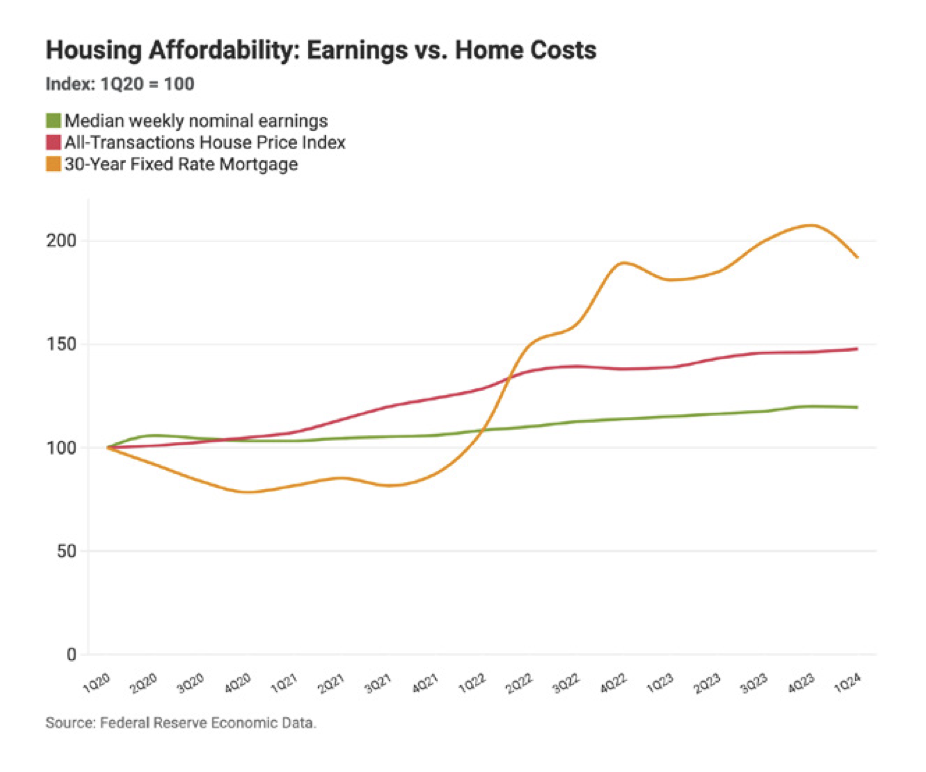

According to PwC’s Emerging Trends on Real Estate 2025, the market is nearing an upswing, so it’s time to plan for the next phase of growth. Stakeholders in the industry expecting “good” or “excellent” real estate profits jumped from 41% last year to 65% this year. However, it’s crucial to balance home earnings and house costs to ensure affordability.

As a homeowner or renter, you must take a holistic picture of your current finances and plan how to save up on your housing-related expenses. That said, here are key factors to consider for your real estate in 2025:

- Income source for real estate: Make sure you have a steady income to cover your housing needs, whether it’s from your job, business, or side gigs. This helps you stay consistent with rent or mortgage payments.

- Budget for housing cost: Track how much you spend on housing each month, including rent or mortgage, utilities, insurance, and maintenance. Aim to keep it within 30% of your total income.

- Emergency fund readiness: Always have some savings set aside for unexpected housing costs like repairs or sudden rent hikes. A good rule is to save at least 3–6 months’ worth of expenses.

- Credit health management: Keep an eye on your credit score. Why? It affects your ability to get loans, refinance, or even qualify for a rental. Pay bills on time and limit debts to keep it in good shape.

- Savings for future housing goals: Whether you plan to buy a home, move to a better rental, or invest in property, start saving early. Set clear goals and tuck money away regularly to reach them faster.

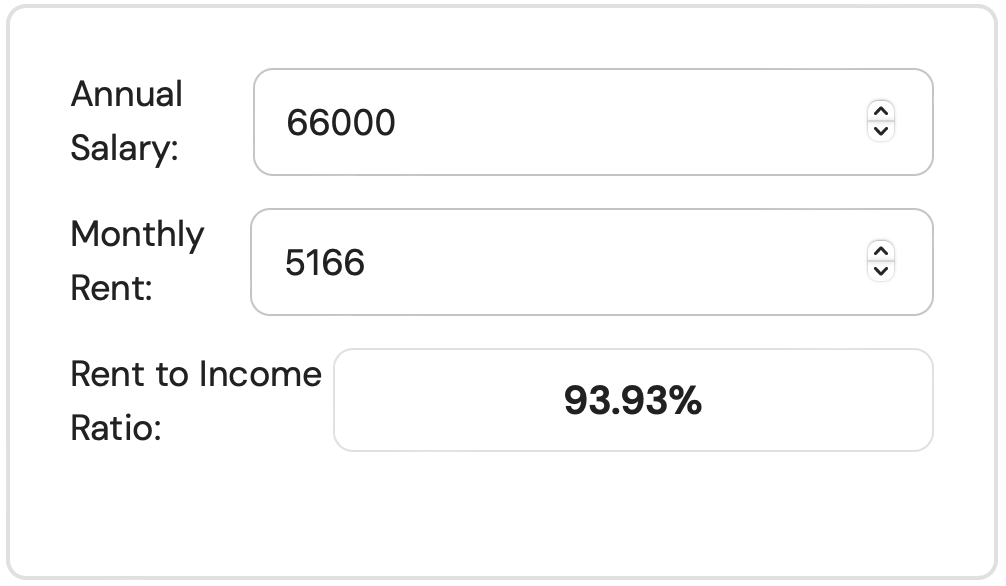

In short: List your total earnings and all your housing costs, then calculate all your expenditures and set a budget for each item. You can use a rent-to-income ratio calculator to strike a balance between your income and expenses. Ultimately, all these will help you stay on top of your real estate finances!

Take a look at this simplified calculator, for example. By listing your annual salary and monthly rent, you’ll be able to get your rent-to-income ratio. However, there are more advanced tools you can use to compute. That can help you make informed real estate decisions.

For more financial planning tips on real estate, continue reading in the next section.

Practical Tips on Financial Planning for Homeowners and Renters

Financial planning is key to maintaining your financial health. It helps you meet your expenses and avoid potential debts while also saving money in the long term. This is crucial in navigating the real estate market!

As a homeowner or renter, it’s essential to plan and prepare for your housing costs. That way, you won’t end up getting personal loans to cover all your expenses. Or worse, you won’t get evicted from the property for not paying your mortgage or rent.

Don’t worry—here are some practical tips on financial planning for you:

Homeowners:

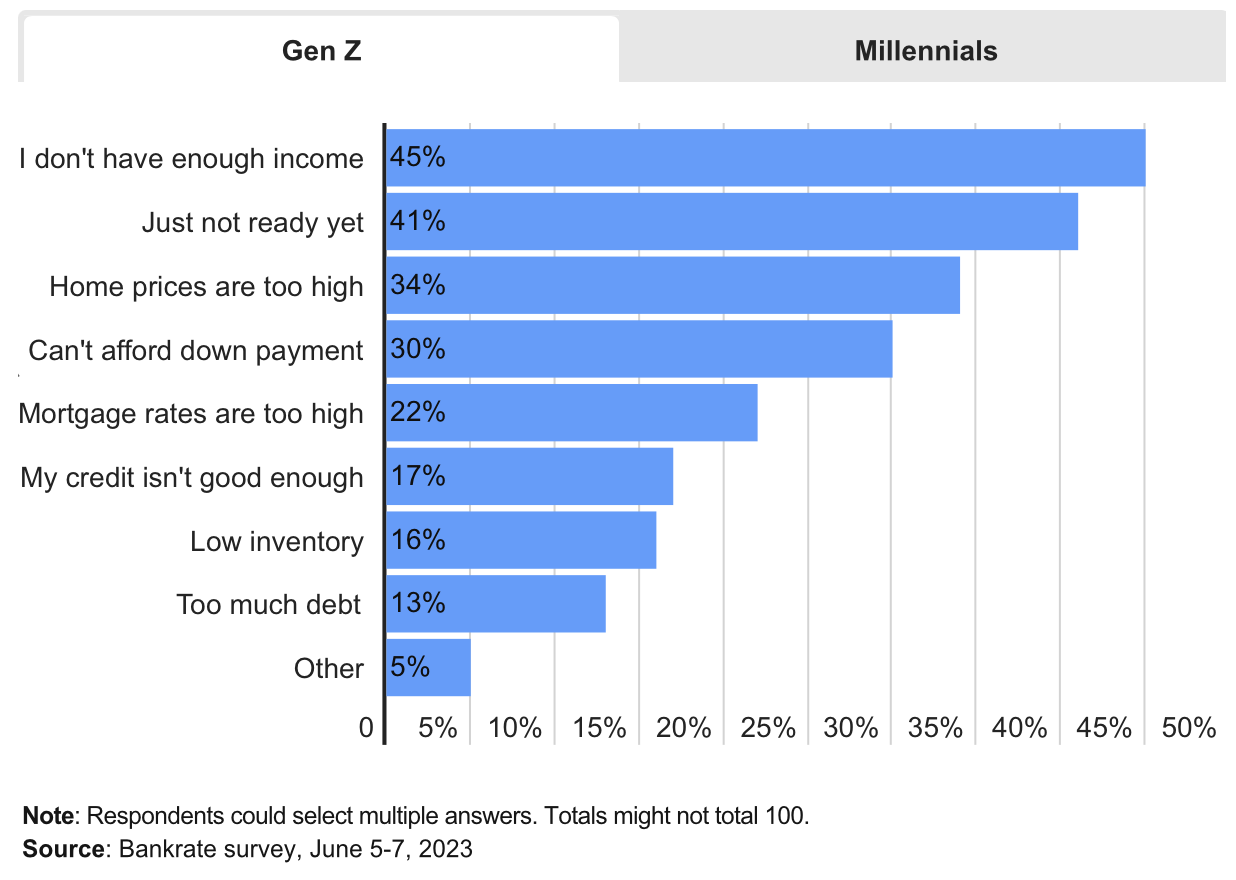

The real estate market has been thriving, making home-buying a lot easier than ever before. However, younger adults—both Gen Zs and Millenials—are now facing affordability issues with their home purchases. Not having enough income (45%) is the primary reason why they still don’t own a house.

Grant Aldrich, Founder of Preppy, recommends investing in real estate and owning a property. However, he warns that maintaining your housing costs can be a lot harder than buying a house itself.

Aldrich explains, “Buying a home is a big step, but the real challenge is keeping up with the costs that come after. From repairs to rising property taxes, it’s easy to get caught off guard if you don’t plan ahead.”

As a homeowner, here’s how to plan for managing your real estate finances:

Reassess your mortgage payment

If you’ve purchased a residential property, you’re likely paying a monthly contractual payment (MCP)—a set amount that includes your loan’s principal and interest over a specific term. It’s essential to review this regularly, especially if you have an adjustable-rate mortgage (ARM), as your payments can fluctuate over time.

Whenever possible, consider making extra payments toward your principal. Doing so can help you pay off your loan faster and build a safety cushion in case unexpected costs arise. Just like using a professional invoice email template enables you to stay organized in business, keeping your mortgage payments in check ensures better control over your long-term finances.

Plan for ongoing maintenance costs

Homes naturally experience wear and tear over time, and ignoring minor issues can lead to costly repairs later on. That’s why it’s essential to allocate a budget for regular maintenance and unexpected repairs. Even simple tasks like cleaning gutters or checking for leaks can save you from major expenses down the line.

If you live in a high-risk area like California—where wildfires can damage your property—planning for consistent upkeep is even more crucial. In some cases, homeowners opt for California debt consolidation to manage multiple housing-related expenses under a single loan, making it easier to stay on top of their costs.

Make the most of your home equity

Home equity is the difference between your property’s current value and your outstanding balance. You’ll build more of it when you make more payments and the value of your property increases. That’s why you should also pay attention to your home equity as part of your financial planning.

How does it work? In real estate, you can access your home equity for expenses like home improvement projects, family emergencies, and even debt consolidations. However, be careful not to borrow more than you can repay. Ultimately, it can be a powerful tool when used wisely and strategically.

Prepare for property tax and insurance

Did you know your monthly mortgage payment can also be escrowed? This means your property taxes and insurance are bundled into your MCP, along with your principal and interest. It’s a smart move for financial planning since it helps you stay on track with payments and avoid late fees or penalties.

Just like NDIS providers Sydney help clients manage and coordinate multiple support services, bundling your housing costs into one payment can simplify your finances and make long-term planning much easier. This setup gives you peace of mind, knowing your essential expenses are handled consistently and on time.

Renters:

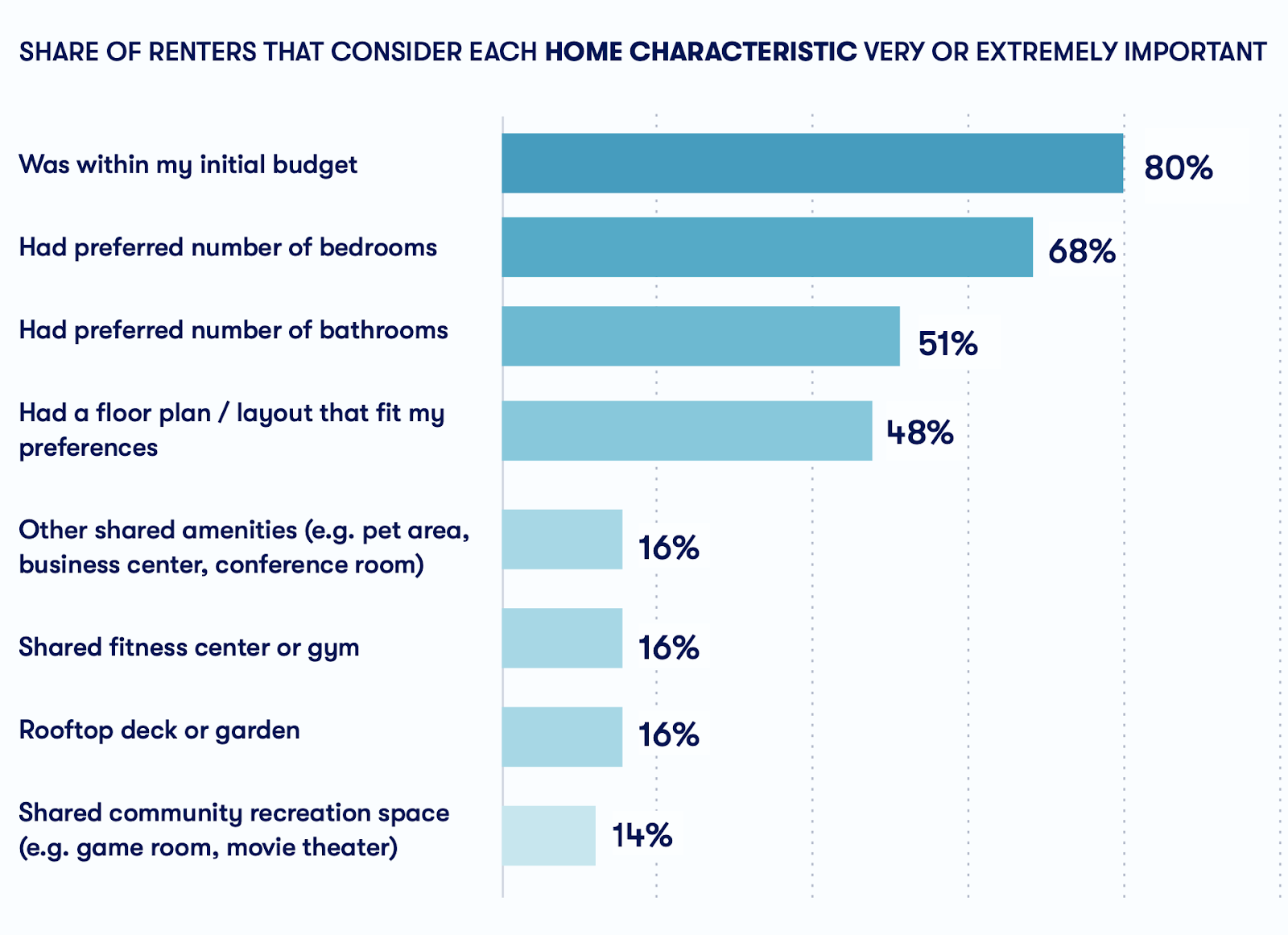

People have various reasons for renting—and they have specific home characteristics they’re looking for in a rental property. But according to Zillow Rentals, 80% of renters consider ‘affordability’ a top priority in real estate.

Emily Ruby, Owner of Abogada De Lesiones, suggests reviewing lease agreements before making a final rental decision. She believes that the financial aspect of renting is the most critical thing you shouldn’t ignore.

Ruby shares, “Renting isn’t just about finding the right space—it’s about knowing exactly what you’re signing up for. Always go over the lease terms and total costs so you don’t end up paying more than you expected.”

It’s no secret: Renting a place can be expensive these days. Of course, you have to pay for your rent every month; You also have to consider all other related expenses. As a renter, you want to be able to save money on your rent and other costs. Here’s how:

Understand your lease terms

A lease contract is essential in a rental agreement because it protects both the landlord and the tenant. As a renter, it’s vital to read the fine print before signing and to review the terms and conditions regularly to stay on top of your financial responsibilities.

Just like using custom voice AI helps personalize and clarify communication in tech, understanding your lease terms ensures clear expectations and helps prevent costly misunderstandings. Staying informed puts you in a better position to manage your rent and avoid unexpected fees.

Plan for yearly rent increase

There’s no denying the rising costs in real estate—rental payments included. As a tenant, it’s crucial to prepare financially for your rent increase almost every year. Include rent hikes in your annual budget so you can keep up with your monthly payments all year round.

However, it’s best to research rental trends in real estate prior to this. Find out the standard market value in your location based on your property type and its amenities. If possible, negotiate with your landlord and/or property manager to see if you maintain the rental payment or lessen the increase.

Take advantage of renter’s insurance

Renter’s insurance is exactly what it sounds like—insurance for tenants renting a property, whether a house, apartment, or condominium. This policy is designed to protect you from financial and legal liabilities as a renter in case of unforeseen events. So, it’s best to capitalize on it as part of your financial planning.

Renter’s insurance comes in different types. For example, you can get insured for your personal belongings in case of thievery, fire, flood, and other natural calamities. You can also have a liability insurance policy to pay for medical expenses if someone gets hurt on your residential property.

Save for future housing goals

Almost everyone aspires to have their dream house one day; Others hope to get a comfortable rental place to stay. But whether you’re planning to buy a home someday or move to a better rental, start saving as early as possible. Having a clear goal helps you stay focused and build a solid financial foundation.

One way to get started is to calculate your expenses for renting an apartment. This gives you a realistic view of how much you’ll need and what you can afford. From there, you can create a savings plan that fits your lifestyle and future goals. Remember, financial planning for your future home can significantly impact your life.

Final Words

Effective financial management in real estate requires proper financial planning. Whether you’re a homeowner or renter, carefully plan on managing your whole finances and budgeting all your housing-related expenditures. The goal isn’t only to settle all your expenses but to save money in the long run.

That said, consider the key factors for your real estate financial planning: Income source, housing budget, emergency fund, credit health, and savings. More importantly, follow our practical tips for managing your finances as a homeowner or renter. With all these valuable tips and steps, you’ll be able to stay on top of your real estate expenditures!

If you’re looking for a place to stay in the U.S., check the June Homes’ wide range of reliable rental listings—To get started, sign up now! For more expert insights on housing or renting, check our blog today.